24+ Permanent life insurance

Invest additional dollars above the cost of insurance into. Meet With An Advisor In-Person Or By Phone To Learn About The Benefits Of Whole Life.

1

Permanent life insurance is designed to last your entire life.

. Ad Find the Top Permanent Life through National Family Buy Online On the Phone. Permanent life insurance is tax-free meaning the amount you accumulate is non-taxable until the policy is active. Call a licensed expert.

Ad Get an instant personalized quote and apply online today. Term life is less expensive especially when you buy it early in life. This allows you to.

Permanent life insurance is a type of coverage that remains in force for the policyholders entire life as long as premiums are paid. Term life insurance is a policy that lasts a certain number of years. As long as you pay your premiums your coverage stays in force.

Permanent life insurance is a policy that pays a death benefit to your beneficiaries upon your passing. Come Back And Let Us Help You Prepare. As Low As 349 Mo.

Apply for guaranteed acceptance life insurance. Ad Our Comparison Chart Makes Choosing Simple. A 30-year-old woman can expect to pay.

With permanent life insurance you dont have to. However taxation might apply when you withdraw your. Get 250000 In Coverage For As Low As 10Month.

In a nutshell. Permanent insurance can last for a policyholders entire life. The insurance company covers the cost of this health check which often includes your weight height and medical.

The permanent insurance policy is ofcourse more expensive than term life insurance. This can make it an attractive option for those who want to. Permanent life insurance plans term life insurance rates chart by age permanent life insurance for seniors permanent whole life insurance rates aarp permanent life insurance rates what is.

GVUL combines life insurance protection with tax-deferred investment options. Talk To An Advisor Today. 2 days agoAccess a permanent life insurance policy.

We Have Options That Are Right For You. Permanent life insurance is generally more expensive than term life insurance. Ad Exclusively for AARP Members.

A permanent life insurance policy usually requires a medical exam. A permanent life insurance policy allows you to invest in an account with a tax advantage which you can borrow from or use during the duration of the policy as well. Ad Whole Life Insurance Provides Flexibility And Stability.

Permanent life insurance and term life insurance both offer financial security to your loved ones when you die but are otherwise very different. A few examples of the types of Permanent Life Insurance that are out there. Meet With An Advisor In-Person Or By Phone To Learn About The Benefits Of Whole Life.

It also includes a cash value component which allows you to save money. Options start at 995 per month. The Most Reliable Permanent Life Insurance Providers That Have Your Interests At Heart.

Ad SBLI Has Been Protecting Families For Over 110 Years. You cant be turned down due to health. No Medical Exam - Simple Application.

The four main types of permanent life insurance are whole life universal life variable life and variable universal life. You can buy a term life policy for 10 20 25 or 30. Talk To An Advisor Today.

Apply Online In Just Minutes. Typically builds cash value over time and has dividends payed into the cash value by the insurance. Ad Whole Life Insurance Provides Flexibility And Stability.

For a quick comparison of the cost of different types of life insurance take a look at some Allstate sample quotes for 250000 in coverage for a healthy individual. Ad Now Is The Time To Get Life Insurance. November 24 2021 Deciding whether term or permanent life insurance is a better fit for your family comes down to a combination of factors namely desired price point policy.

As Low As 349 Mo. Definition of Voluntary Life Insurance. Voluntary life insurance is a type of financial protection plan that pays a cash benefit to a beneficiary in the event of the insureds death.

Term is for a specific number of years. Term life insurance policies. Compare Find the Best Policy For You Save.

Recent data from the Federal Reserve lists the average interest rate for a 24-month personal loan at 873. Rates starting at 11month. Get A Free Quote Or Apply Online.

One major difference between the two types of policies is that permanent is for life. The types of permanent life insurance includes. Ad No Medical Exam-Simple Application.

This is true for both men and women according to our research. Thats because these plans come with added features and benefits beyond what term life offers. Permanent life insurance is lifelong insurance coverage for those who want more flexibility and a longer policy term some insurance companies cover up to 121 years.

1

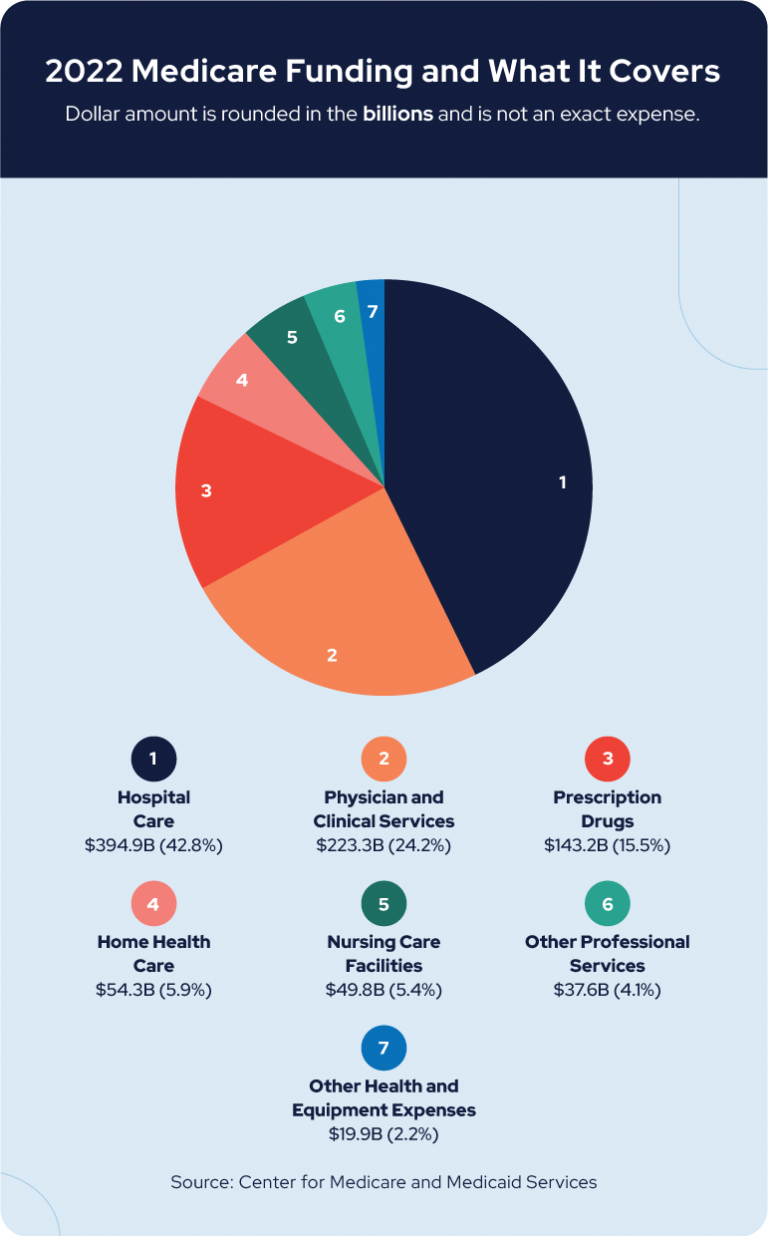

21 Essential Facts About Medicare To Know In 2022

Which State In The Us Provides The Best Insurance Plan For Infertility Treatments Quora

31 Video Marketing Strategies And Ideas For Insurance Agents Video Marketing Strategies Insurance Marketing Life Insurance Facts

1

28 Ways To Get More Insurance Agency Facebook Fans Lifeinsurancetips Insurance Agency Insurance Sales Life Insurance Quotes

What Are The Best Life Insurance Companies In 2019 Quora

Transparent Aegon

Er Nakul Soren Nakul Soren Twitter

Erie Insurance Review Auto Home And Life Insurance In 12 States

24 Total Compensation Statement Excel Template Statement Template Employee Benefit Excel Templates

Aegon Life Insurance All You Want To Know About Aegon Life Insurance

Pricing Truth Concepts

29 Ideas To Cross Sell More Insurance To Current Clients Insurance Agent Life Insurance Policy Insurance Sales

2

Felicia Kestenberg Founding Partner Kesten Financial Group Linkedin

Networking Tips For Insurance Agents 34 Smart Ideas Pet Insurance Pet Insurance Dogs Pet Insuran Life Insurance Facts Insurance Agent Best Health Insurance